CFA Institute Research Challenge Champions!

In only the second year a USF team has participated in the competition, the School of Management team bested 16 other teams in a highly competitive region including schools such as Haas Business School, UC Berkeley, Wharton Business School and many other outstanding universities.

They went on to represent Northern California—and the Dons—at the CFA Research Challenge national competition in Chicago this April.

SooMan Wolffs, MSFA ’16, shared his account of the winning team’s trip to nationals!

Northern California Champions

This is the 10th year of the CFA investment research challenge and the 7th time that the CFA Society San Francisco, CFASF, participated in the global event.

The competition began back in December when we registered our team of five to participate.

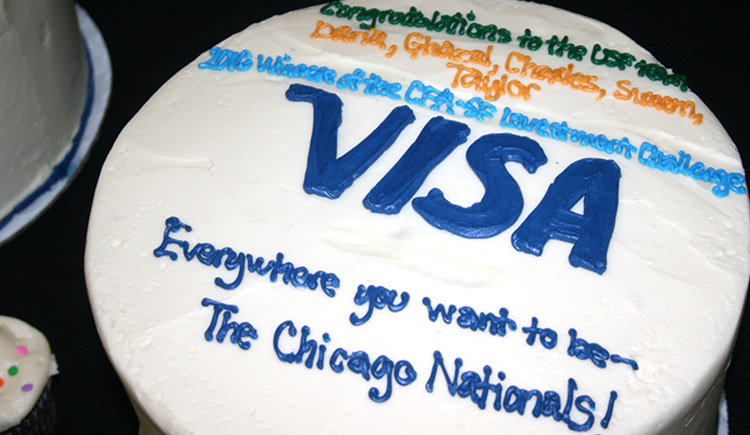

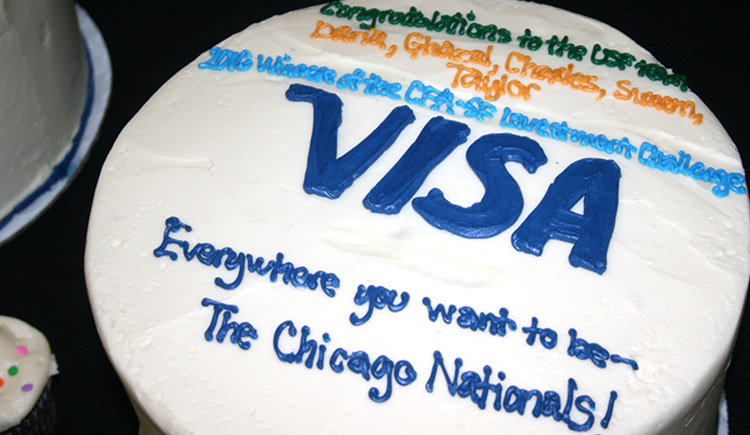

All teams in the local Northern California region had one vote for one of the five local companies to research. The five initial companies were Visa Inc., LinkedIn, Ross, Clorox and Intuit. The company with the most votes was chosen as the company to analyze for all teams participating in the area--and Visa was chosen as the majority winner.

We began researching Visa by reading and analyzing their public filings. To fully understanding the company, we arranged phone calls with investor relations, met with senior management and listened to earnings calls. Then we read many other professional research reports about Visa and the electronic payment industry to fully understand Visa’s role within it.

The competition consisted of writing a research report which was 10 pages long coupled with an unlimited amount of appendix pages as each team saw fit (our submitted report consisted of 10 pages and 18 pages of appendixes.)

The report consisted of many parts including our buy recommendation, the industry and Visa’s place and competitive advantage within it, a SWOT analysis, a “Porter’s Five Forces analysis” and their acquisition analysis for future growth.

The quantitative portion of our report included models such as a Dividend Discount Model and a Discounted Cash Flow consisting of three different scenarios--a best, base and worst case. We did other quantitative analysis including multiple and comparable analysis.

The report was submitted in late February, and then we constructed a PowerPoint presentation of our findings for judging.

The presentations took place in early March at the Bank of America building in San Francisco.

In total, there were 17 local teams participating in the challenge. In the initial round we went into a private room to present our PowerPoint to three judges. The format was 10 minutes of presentation and 10 minutes of Q&A. Each team presented and was graded. The weightings to go onto the final was 50% report and 50% presentation.

After the grading was finished, two finalist teams were chosen to present again in front of all the competitors, and the grading at this stages was 100% presentation based. Our USF School of Management team was selected as the finalist against UC Santa Cruz. The format was the same as earlier presentations with 10 minutes of presenting and 10 minutes of Q&A. After both presenting, we were selected as the winner--which meant we would represent the CFASF in the national level competition in Chicago.

Representing the Dons at Nationals

The competition was broken down into the 4 main geographic segments: America A, America B, EMEA and Asia Pacific. Within each segment, the competitors were broken down in to groups of five or six.

Each group presented to a group of judges with the same format--10 minutes of presentation and 10 minutes of Q&A. From each group a winner was chosen to go to the semifinal for each region. This is where our group, USF, as well as almost 80% of the field was wiped out from the competition.

The winners went to another round of presentations with the same format, and one winner was chosen to represent each geographic segment for the global final taking place the next day. The winning team from our group was the University of Waterloo, who eventually won the entire competition.

Invaluable Learning

This competition is truly important because it helps bridge the gap between academic learning and real world application.

The amount of hours our team put in doing due diligence was astronomical. Taking book concepts and learning how different they are in a real world scenario was illuminating.

This competition has prepared me for the workplace, and I would highly recommend it to future students who want to take the next steps in strengthening their financial skillset. I feel validated that I am ready to apply my skillset to the real world now." SooMan Wolffs, MSFA ’16

A special thanks to our academic advisor Michael Maestas who continually helped us improve our report and models. Without him, we would not have been able to make it past Northern California regionals. He was truly interested in deepening our learning, and that is why I feel we competed at such a high level.